While the tax bills were generally applauded, stakeholders urge caution on implications for transparency and accountability in extractives

Stakeholders have raised concerns over the potential impact of the proposed Nigeria Tax Bill (NTB) and other related reforms on the extractive sector.

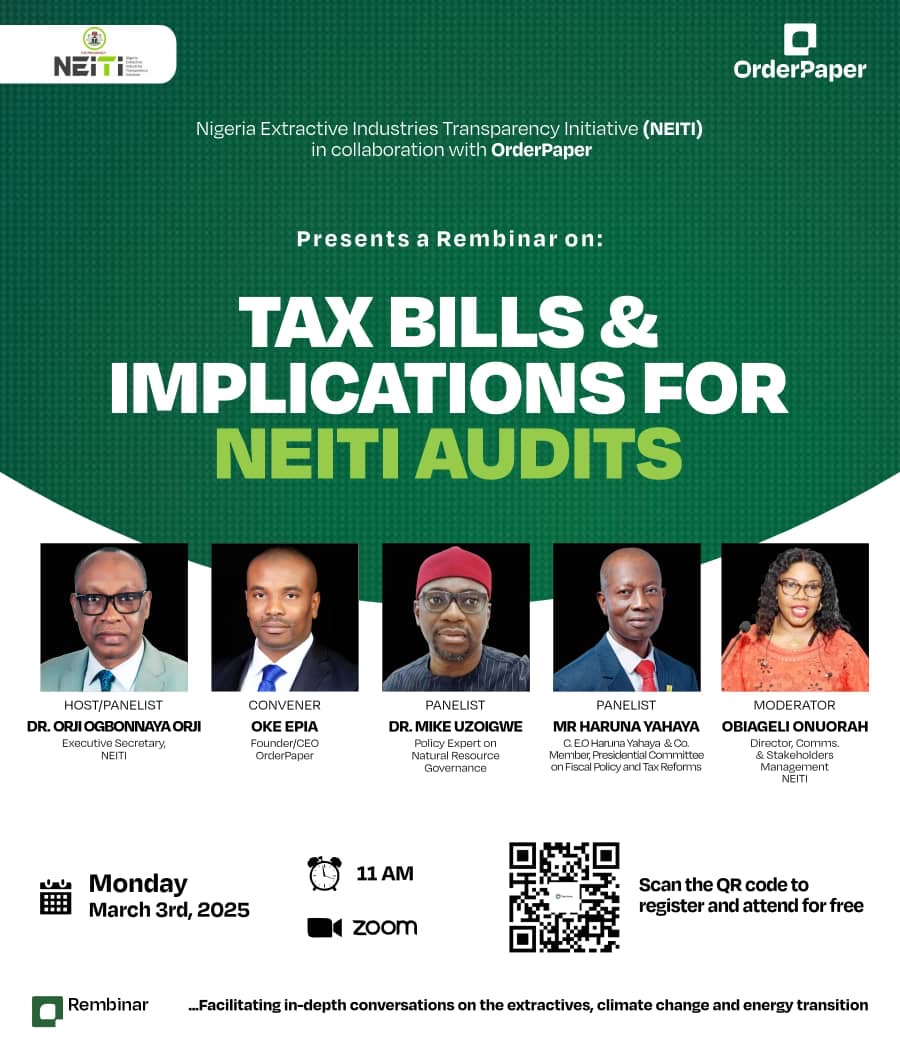

The reforms, however, received generally positive commentaries from speakers and contributors during a stakeholder engagement session convened by OrderPaper Nigeria in collaboration with the Nigeria Extractive Industries Transparency Initiative (NEITI) which held on Monday, March 3, 2025, on zoom.

The event, which was the inaugural Rembinar Dialogue Series, focused on the theme: “Tax Bills and Implications for NEITI Audits” and brought together subject matter experts and stakeholders in the extractive sector to assess the ramifications of the four tax bills currently before the National Assembly. The bills are:

- Nigeria Tax Bill (NTB) 2024

- Nigeria Tax Administration Bill (NTAB)

- Nigeria Revenue Service (Establishment) Bill (NRSEB)

- Joint Revenue Board (Establishment) Bill (JRBEB)

The proposed legislations seek broadly to consolidate multiple tax laws into a single framework and introduce the Nigeria Revenue Service (NRS) to replace the Federal Inland Revenue Service (FIRS) to take over tax collection duties from various agencies, including the Nigeria Customs Service and the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

NEITI applauds but cautions…

Speaking at the dialogue, NEITI’s Executive Secretary, Dr. Orji Ogbonnaya Orji, described the tax reform as a “bold attempt to modernise Nigeria’s tax system.” However, he cautioned that global best practices favor decentralised tax administration, warning that excessive centralisation could pose challenges for regulatory oversight and institutional efficiency.

According to Orji, the extractive sector accounts for a substantial share of government revenue and foreign exchange earnings, yet it continues to suffer from tax evasion, revenue leakages, weak enforcement, and a lack of transparency in fiscal regimes.

He disclosed that NEITI has submitted its position on the tax bills to both the National Assembly leadership and the Presidential Committee on Tax and Fiscal Reforms (PCTFR), highlighting areas of concern and recommendations.

He said, “NEITI carefully examined the bills and acknowledged all its potentials to improve tax administration, streamline legal frameworks and enhance compliance across various industries including oil and gas and mining.

“We have forwarded our position in no mistakable term to the leadership of the national assembly and to the presidential committee behind the initiative.”

READ ALSO: OrderPaper, NEITI Collaborate on Rembinar Dialogue Series on Resource Governance

Dr. Orji highlighted several critical elements of the proposed tax legislations, including the consolidation of tax laws for improved clarity and to reduce ambiguities in tax administration, digitalisation of tax payments which is targeted at improving efficiency and reducing corruption, stronger anti-tax avoidance measures and reforms in VAT, double taxation, and incentives for private sector initiatives.

How the tax bills could affect NEITI audits

Dr. Orji emphasised that NEITI’s audit functions are deeply intertwined with Nigeria’s public finance management system, as the bulk of extractive revenue falls within the scope of taxes and levies such as Petroleum Profit Tax (PPT), Value Added Tax (VAT), Education Tax, and crude oil sales revenue.

“So, any legislation that is likely or unlikely to alter the current status quo in this whole process should be of very good interest to NEITI. NEITI must be interested in what is going to change, how will the change come, and who will benefit from the change.

“The whole essence of EITI is prudent management of natural resources so that the revenues from these natural resources can support national development and reduce poverty.

“That’s why when we wanted to know exactly how the proposed legislations would affect VAT computations, taxes computations in education tax: is it going to increase or reduce government take? We wanted to be sure of all the kinds of collectible revenues that come under EITI audits, how are they going to be affected by the new legislation? Is it progressive or is it retrogressive?” he questioned.

While acknowledging the potential benefits of the reforms, Dr. Orji outlined critical areas for improvement and made formal submissions to policymakers, emphasising the need for enhanced clarity in tax computation methods, balanced approach to taxation that does not discourage investment, ensuring the new tax system aligns with Nigeria’s Extractive Industries Transparency Initiative (EITI) commitments and the importance of maintaining institutional efficiency in revenue collection

He reaffirmed that NEITI supports the bills in principle, as they offer more opportunities than drawbacks for the extractive industry. However, he stressed that continuous stakeholder engagement is necessary to refine the proposed legislation and address lingering concerns.

“In specific term, we support the bills quite frankly, because what we found in the bills is that the benefits and opportunities created were more than the areas that we think improvement should be made.

“But is NEITI interested in this legislation? Yes. Does it affect our work? Yes. How does it affect our work? It could affect our work positively and in some areas, negatively because there are areas that taxation would have been an issue for investors if they are not well addressed and because if you have high taxes, without commensurate cushioning effect, it could be a disincentive to investors.

“All the areas we felt will be a challenge in the implementation as it affects the extractive sector we identified in our submission and this was the whole essence of opening up the draft laws for public scrutiny.

“We also raised an issue about the possibility of consolidating all revenue connections in terms of taxes or in the Nigerian Revenue Service as proposed by the bill.

“We raised those issues and we asked them for explanation and we equally recommended that they take a second look at that because now the the trend all over the world is a decentralisation of functions for greater efficiency; building smaller efficient institutions that take specific responsibilities and then improving the efficiency,” he added.

Call for stakeholder engagement

Speaking during the dialogue, Oke Epia, Founder/CEO of OrderPaper and Convener of the Rembinar Series, commended NEITI for its longstanding collaboration with OrderPaper, noting that the two organisations have worked together on various initiatives aimed at strengthening public finance management and resource governance.

He emphasised the need for multi-stakeholder participation in Nigeria’s tax reform process, stating:“We have had a very robust and productive working relationship with NEITI. OrderPaper would like to put it on record that we are grateful to NEITI.”

Epia also spoke extensively about RemTrack, a flagship civic technology platform developed by OrderPaper in partnership with NEITI to enhance citizen engagement and track compliance with NEITI audit recommendations.

“RemTrack is a flagship of the collaboration that OrderPaper had with NEITI over the years, going to seven years. RemTrack is a civic tech tool that was created to enable stakeholder participation, especially citizen engagement in tracking the recommendations of NEITI audit and because it is a tool that is built to scale, we are in the process of scaling and expand its scope to the emerging issues in resource governance, especially those around the EITI standards, including the energy transition.”

He revealed that OrderPaper is currently expanding RemTrack’s scope to cover emerging issues in resource governance, including energy transition, climate change policies, beneficial ownership disclosures, host community rights, and contract transparency.

Epia stressed that public engagement in tax policy and fiscal governance is crucial, adding that OrderPaper’s Rembinar Series will continue to focus on these critical themes.

“It is when the country is doing well economically that the pockets of Nigerians are also doing well, so it behoves on us to show a lot more interest in what these tax reforms mean to us as resource governance experts and as citizens generally,

The discussion also featured insights from distinguished panelists, including: Dr. Mike Uzoigwe, Policy Expert on Natural Resource Governance and former Country Manager (Anglophone & Lusophone Africa) for the EITI, and Haruna Yahaya, Member of the PCTFR.

These experts provided in-depth analyses of the potential impact of the tax reforms on Nigeria’s extractive sector, with particular emphasis on compliance mechanisms, investor confidence, and revenue accountability.