The House of Representatives has reaffirmed its commitment to deepening access to finance for SMEs and strengthening consumer protection in Nigeria’s financial sector

The House of Representatives on Thursday reaffirmed its commitment to deepening access to finance for small and medium enterprises (SMEs) and strengthening consumer protection in Nigeria’s financial sector.

This was as the Committee on Banking Regulations held a public hearing on two key reform bills.

The bills under consideration include:

- A Bill to Regulate Factoring, Purchase of Receivables, and Establishment, Operation, and Control of Factoring and Receivables Financing Businesses (HB. 516), and

- A Bill to Amend the Banks and Other Financial Institutions Act (BOFIA) 2020 (HB. 1160), aimed at protecting victims of fraudulent withdrawals from bank accounts.

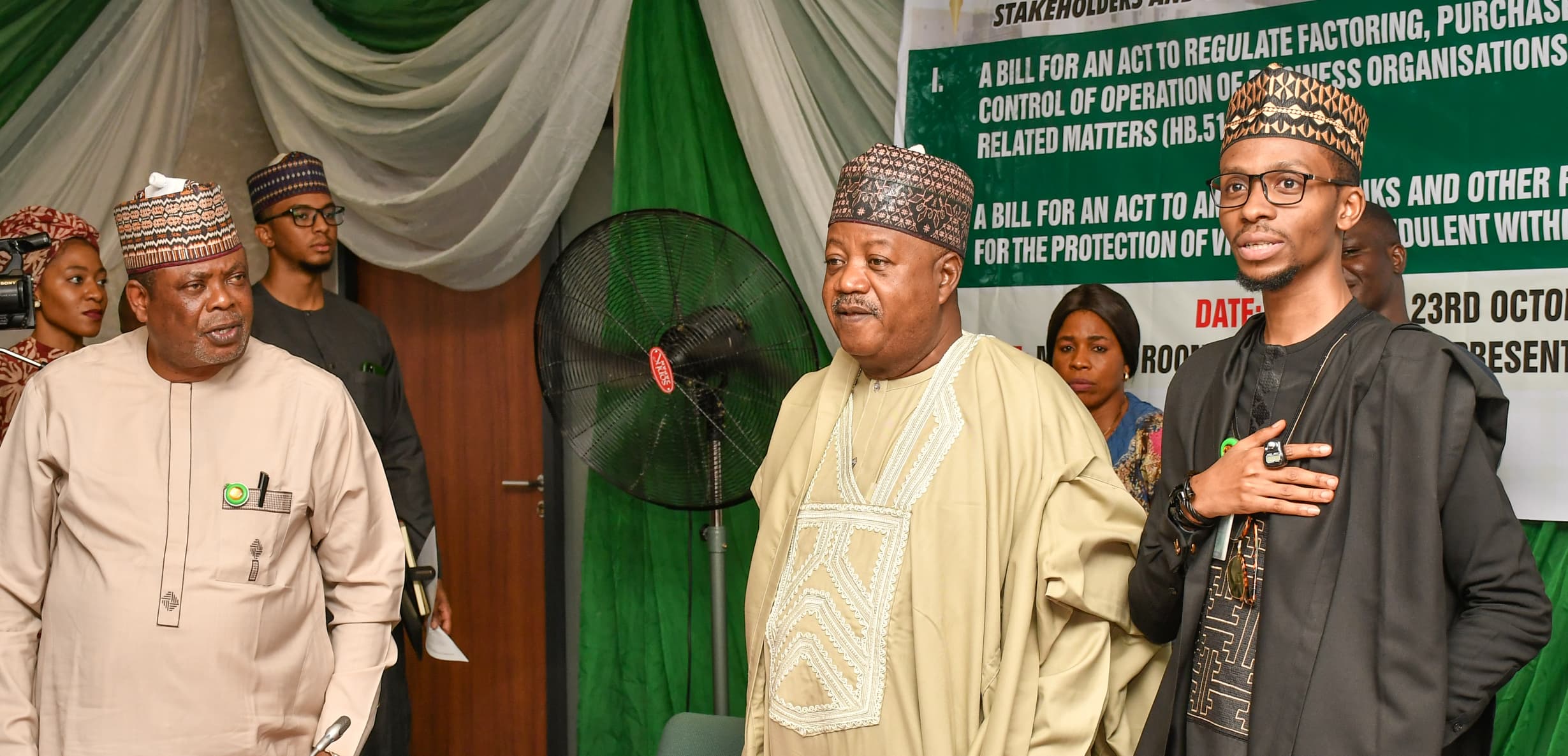

Declaring the hearing open, Chairman of the House Committee on Banking Regulations, Rep. Mohammed Bello El-Rufai, said the two bills represent the National Assembly’s drive to strengthen the country’s financial framework and enhance trust, transparency, and stability in the banking system.

“It is my honour to welcome you to this public hearing. It brings before us two important bills that reflect this Committee’s continuing commitment to strengthening Nigeria’s financial system,” Rep. El-Rufai said.

He explained that the first bill seeks to provide a legal framework for factoring and receivables financing, which would expand access to finance for small businesses, promote liquidity, and align Nigeria’s trade finance system with global best practices.

“This Bill seeks to deepen access to finance for small and medium enterprises, promote liquidity, and align our legal framework with international best practices in trade finance,” he stated.

El-Rufai further noted that the proposed amendment to BOFIA, sponsored by Rep. Moses Oluwatoyin Fayinka, focuses on protecting victims of fraudulent account withdrawals and strengthening accountability within financial institutions.

“The proposal focuses on protecting victims of fraudulent withdrawals from their accounts and ensuring accountability within the financial system,” he added.

He called on stakeholders to make constructive contributions that would help deliver “legislation that is effective, fair, and responsive to the realities of our economy.”

ALSO READ:Senate tackles exclusion of indigenous businesses from federal contracts

Speaking at the event, Governor of Kaduna State, Senator Uba Sani, represented by his Special Adviser on Research, Documentation and Strategy, Mr. Fabian Okoye, expressed strong support for the Factoring and Receivables Financing Bill, describing it as a vital legislative tool to boost Nigeria’s productive economy.

“This Bill is one that I hold close to heart,” the Governor said. “During my time in the 9th Senate, as Chairman of the Senate Committee on Banking, Insurance and Other Financial Institutions, I sponsored the Factoring, Assignments and Receivables Financing Bill with the goal of establishing a clear legal and regulatory framework for factoring and receivables financing in Nigeria.”

He explained that many Nigerian enterprises deliver goods and services on credit but face long payment delays, leading to cash flow challenges. Factoring, he said, offers a practical solution that allows businesses to raise cash against receivables, meet payroll, and sustain production.

“Factoring provides a practical solution by enabling businesses to convert their invoices and receivables into immediate liquidity,” he stated. “With the right legal backing, Nigeria can unlock similar benefits, attract investors into the factoring space, and strengthen our financial infrastructure.”

Governor Sani emphasized the need for transparency and balance in implementing the framework, ensuring SMEs are protected from predatory practices and that the law aligns with existing financial regulations such as the Secured Transactions in Movable Assets Act and the Companies and Allied Matters Act.

He commended the Speaker of the House of Representatives, Rep. Tajudeen Abbas, for his leadership and the Committee on Banking Regulations under Rep. El-Rufai for “sustaining legislative momentum on critical economic reforms.”

“By organizing this public hearing, the Committee has created an inclusive platform for stakeholders to refine the Bill and ensure that it truly meets the needs of our economy,” he said. “When passed, this Bill will not only expand access to finance but also foster innovation, reduce the cost of credit, and promote sustainable economic growth.”