NEITI’s Dr. Dieter Bassi highlights how fiscal reforms and EITI principles can align Nigeria’s extractive sector with clean energy goals.

The Director of Policy, Planning and Strategy (PPS) at Nigeria Extractive Industries Transparency Initiative (NEITI), Dr. Dieter Ahmed Bassi, has emphasised that adopting Extractive Industries Transparency Initiative (EITI) standards can significantly strengthen transparency and accountability as Nigeria navigates its energy transition.

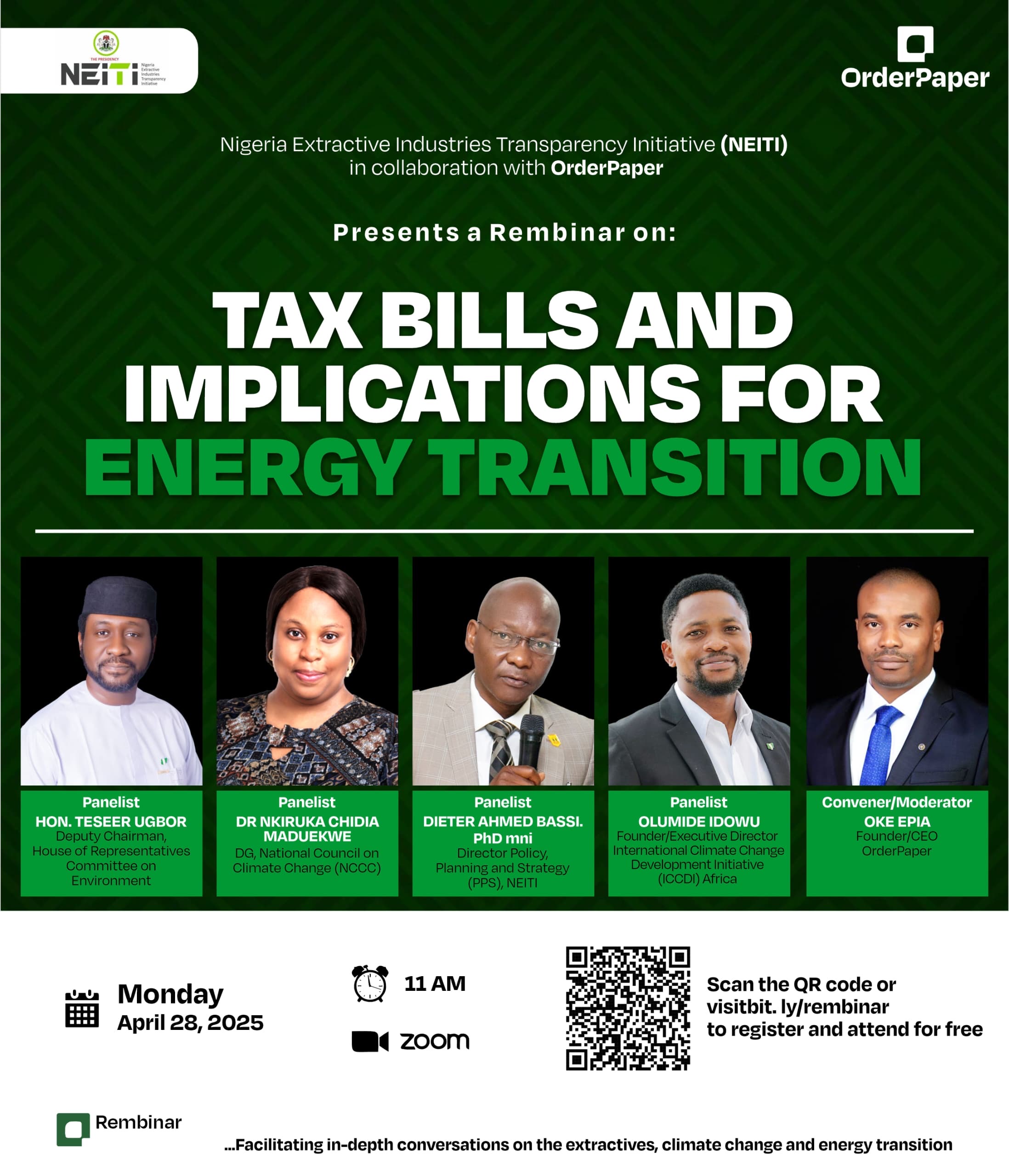

Speaking at the second edition of the Rembinar Dialogue Series held on Monday, April 28, 2025, and themed “Tax Bills and Implications for Energy Transition,” Bassi stressed that adopting EITI principles in the implementation of Nigeria’s energy transition would ensure better fiscal governance, boost investment, and support a just and equitable shift from fossil fuels to clean energy.

The Rembinar is a digital dialogue platform initiated by RemTrack – OrderPaper’s civic-tech innovation for tracking policy performance and enhancing transparency in the extractive sector, in collaboration with NEITI. It is designed to convene key players from government, civil society, and the private sector to examine the intersection of resource governance, public finance, and climate action.

Following the success of the inaugural edition in March 2025, which examined the tax implications for NEITI’s audit work, the second dialogue focused on how fiscal policies, including recent tax reforms, could either accelerate or constrain Nigeria’s transition to renewable energy.

Bassi noted that although Nigeria has committed to achieving net zero emissions by 2060, its heavy reliance on oil and gas, accounting for 80 to 90 percent of government revenues, poses significant challenges. He said the country remains energy-poor, with many households, even in urban areas, lacking reliable electricity access.

He argued that EITI standards, which prioritise data transparency, stakeholder engagement, and accountability, can help Nigeria design and implement energy transition policies that are inclusive and effective. “Energy transition is one of the key components of EITI implementation,” Bassi said, noting that NEITI is well-positioned to monitor reforms to ensure they truly support clean energy goals.

On tax reforms, Bassi welcomed the proposed tax legislations, which consolidates tax collection under a single revenue agency, streamlining what was previously a fragmented system across multiple government agencies. He highlighted the positive alignment between the proposals and energy transition objectives, including tax incentives for renewable energy components such as solar panels and wind turbines.

However, he warned that stronger measures are needed to support local development of renewable technologies and reduce dependency on raw mineral exports like lithium. “Incentives should be put in place for local manufacturing of solar panels and battery development,” he said.

Bassi also stressed the importance of maximising Nigeria’s natural gas resources as a transition fuel, pointing out that the Finance Act promotes gas utilisation through tax breaks for compressed and extra natural gas projects.

Still, he cautioned that current incentives for clean energy investments remain inadequate. “We need a much more robust and clear development for clean energy investment,” he said. He urged the government to fully back such investments to reduce pressure on the national grid and drive decentralised energy solutions.

Furthermore, he flagged the need to plan for the management of stranded assets—investments that may lose value as the world shifts away from fossil fuels. Monitoring the impacts of these reforms, Bassi argued, would be more effective through the EITI framework, which engages companies, government, and civil society to ensure reforms are beneficial and transparent.

READ ALSO: Tax policy must drive Nigeria’s energy transition – NEITI Boss

On his part, OrderPaper Nigeria’s Chief Executive, Oke Epia said the goal of the Rembinar was to advance fiscal reforms, transparency, and accountability in Nigeria’s extractive sector and energy transition efforts.

He expressed optimism that the proposed tax bills would transform Nigeria’s economic landscape, shaping not only investment patterns but also production and consumption behaviours.

He stated, “These are the goals we want to achieve. And the tax reforms must have a way to align these ambitions. The changes we want to see in the fiscal framework must be aligned, otherwise, we will have to suffer not just policy inconsistency but policy misalignment.”

The Tax Bills

In March 2025, the House of Representatives passed four key tax reform bills aimed at overhauling Nigeria’s tax administration and aligning fiscal policy with evolving economic priorities. These bills – the Nigeria Tax Bill (NTB) 2024, Nigeria Tax Administration Bill (NTAB), Nigeria Revenue Service (Establishment) Bill (NRSEB), and Joint Revenue Board (Establishment) Bill (IRBEB), are currently awaiting Senate approval and presidential assent.

For Nigeria’s extractive industries, the reforms promise significant benefits. By streamlining revenue flows and centralising tax governance, the reforms will enhance transparency and accountability, two pillars critical to OrderPaper and NEITI’s mission and to broader EITI standards. This improved structure will also support the shift toward energy transition by enabling more targeted fiscal incentives for clean energy investments and resource efficiency.

The Rembinar Series

The Rembinar Series is a joint initiative by the Nigeria Extractive Industries Transparency Initiative (NEITI) and OrderPaper Nigeria, designed to deepen conversations around resource governance, fiscal transparency, and accountability in the extractive sector.

The inaugural edition, held in March 2025 and themed “Tax Bills and Implications for NEITI Audits,” explored how proposed tax reforms could impact NEITI’s audit processes. It featured expert insights from Dr. Orji Ogbonnaya Orji (Executive Secretary, NEITI), Mallam Haruna Yahaya (member, Presidential Committee on Fiscal Policy), and Dr. Mike Uzoigwe (natural resource governance expert and former EITI country manager), among others. The success of this first session laid a strong foundation for subsequent dialogues.

The second edition focused on how Nigeria’s evolving tax framework could either support or obstruct the country’s clean energy goals. The discussion critically assessed the intersection between fiscal reform and Nigeria’s net-zero ambitions.

Speakers at this second edition included:

•Rep. Terseer Ugbor, Deputy Chairman, House of Representatives Committee on Environment;

•Dr. Dieter Ahmed Bassi, Director, Policy, Planning and Strategy (PPS), NEITI;

•Olumide Idowu, Founder and Executive Director, International Climate Change Development Initiative (ICCDI) Africa;

•Dr. Nkiruka Chidia Maduekwe, Director-General of the National Council on Climate Change (NCCC), represented by Awele Ikobi-Anyali, Head of Legal Department.