With the naira struggling against the dollar, oil production failing to meet targets, and inflation eroding household incomes, the national assembly faces increasing scrutiny over how effectively it can monitor budget performance, enforce compliance from MDAs, and ensure value for money in public spending.

As Nigeria enters the second quarter of 2025, the country’s turbulent fiscal journey is perceived to be stuck in a phase, marked by ambitious spending targets, volatile economic indicators, and mounting pressure on legislative oversight.

With the capital component of the 2024 budget still active and the 2025 budget, initially slated to begin implementation in May, now postponed to July, according to information gathered by Parliament Reports, the country finds itself caught in a pattern of deferred execution, blurred oversight lines, and widening accountability gaps.

This is not merely an administrative lag; it is a structural fault line. The executive continues to assert dominance over the budget process, treating legislative timelines as flexible suggestions rather than constitutional obligations.

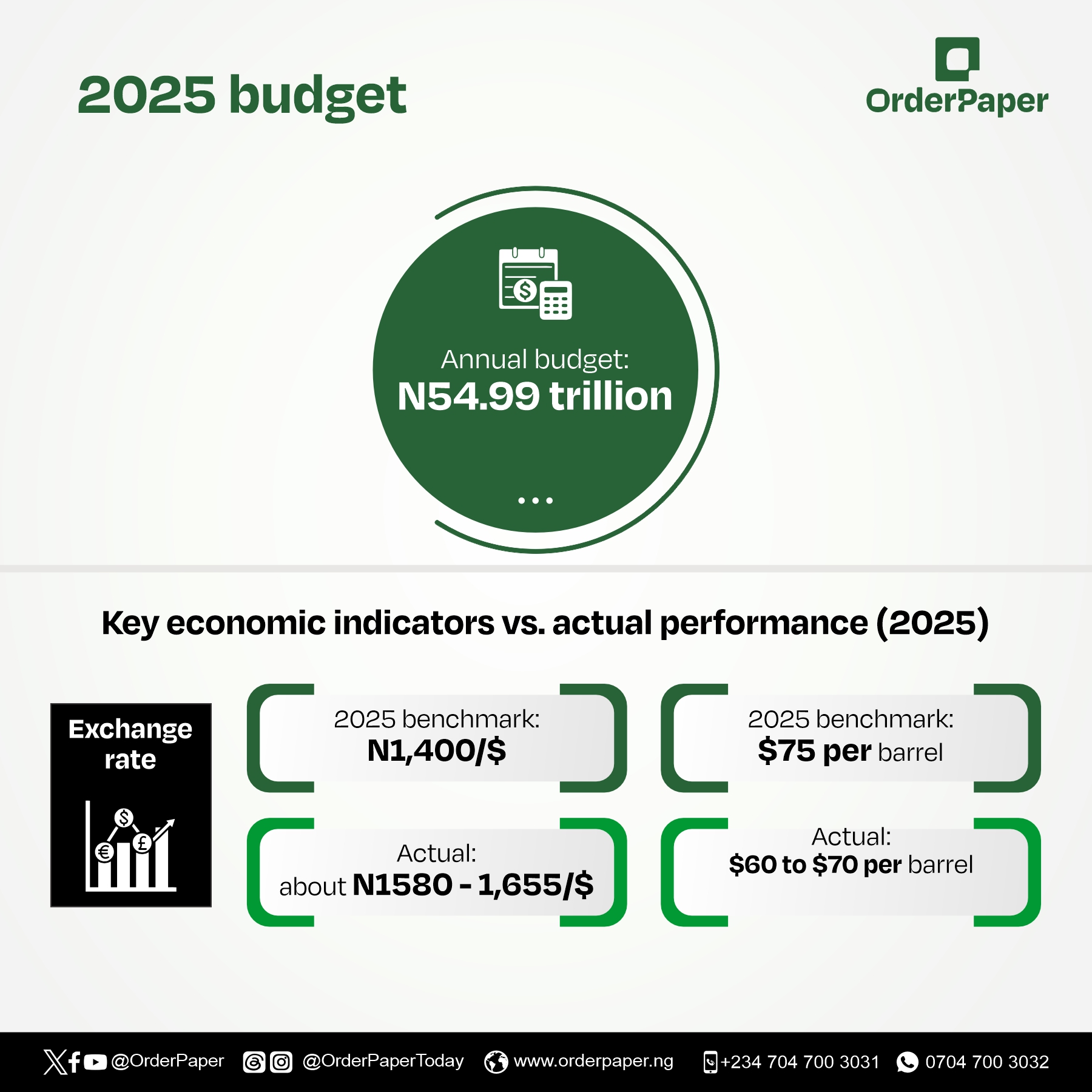

In 2025, the federal government proposed and signed a record ₦54.99 trillion appropriation law, its largest yet, amid rising public expectations and fiscal fatigue. Yet, beneath the bold projections lies a complex history of missed benchmarks, extended capital and supplementary budgets, and underwhelming implementation.

This is not a new story. Over the past few years, Nigeria has repeatedly relied on supplementary budgets and fiscal rollovers to paper over cracks in implementation, often leaving lawmakers to track spending cycles long after they were meant to end. The result is a cumulative burden on the national assembly’s oversight functions, with committees now compelled to interrogate disbursements, procurement, and execution across multiple budget years.

Four budgets ran concurrently in 2024

Nigeria operated under four budgets in 2024:

1. 2023 main budget – Extended for implementation till December 2024.

2. 2023 supplementary budget – Also extended into 2024.

3. 2024 main budget

4. 2024 supplementary budget – Introduced later to cover emerging needs.

2023: A transition year with fiscal realism

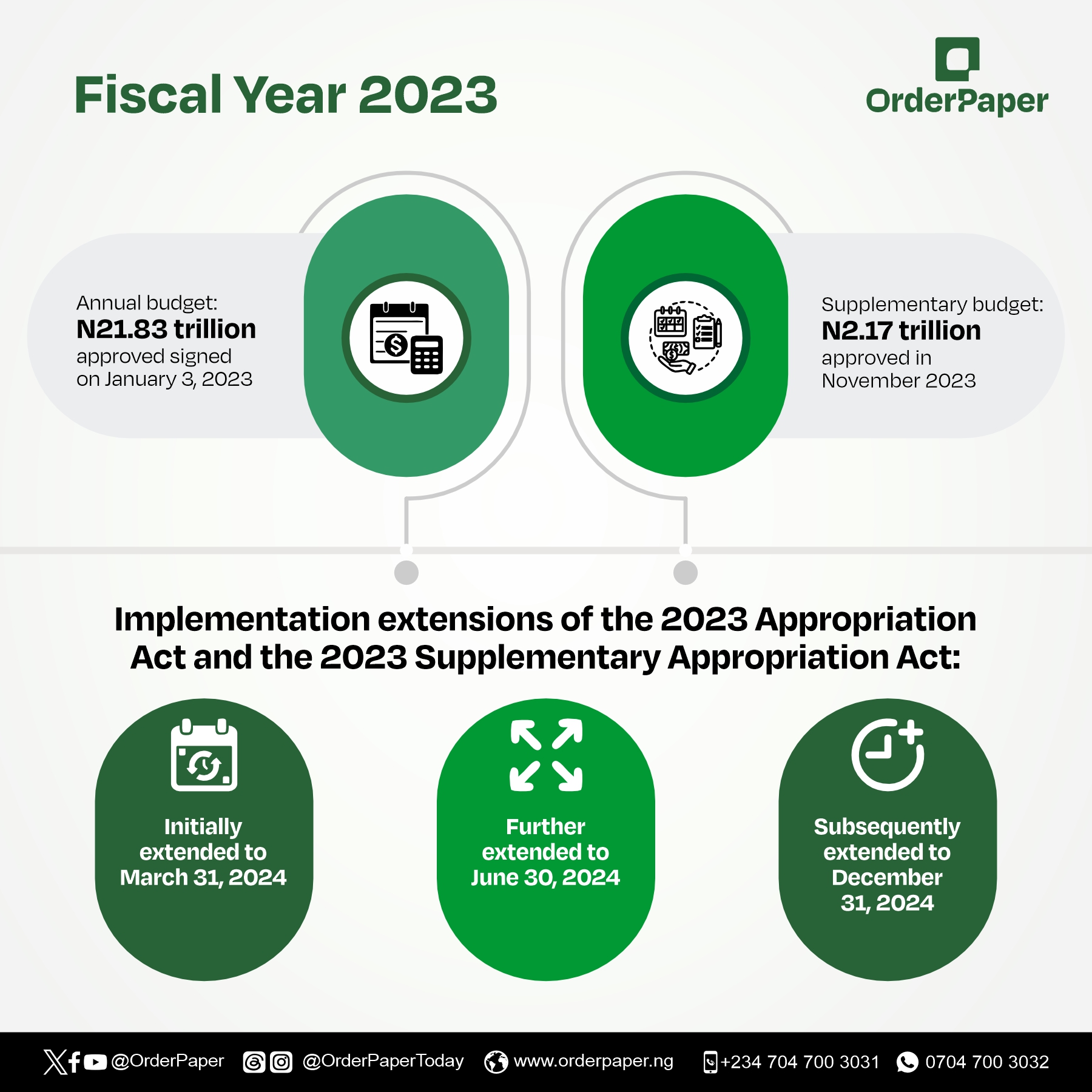

The 2023 fiscal year began with promise, a ₦21.83 trillion budget signed by then-President Muhammadu Buhari on January 3, 2023. It was the last budget of the Buhari administration, and with a supplementary budget of ₦2.17 trillion added in November under the newly inaugurated Tinubu presidency, the total budget envelop reached nearly ₦24 trillion.

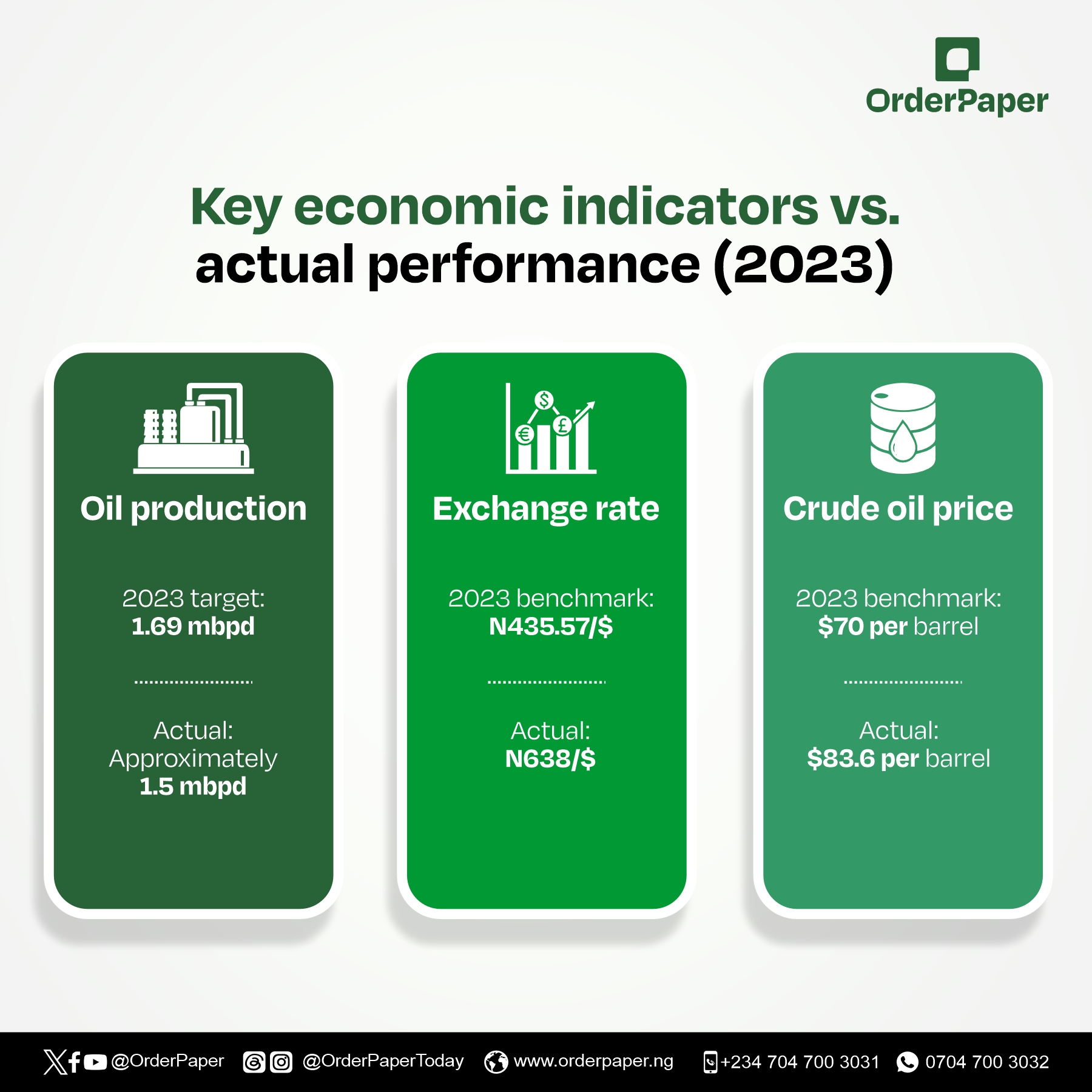

But as with previous years, budget implementation faced severe hurdles. Oil production, the mainstay of Nigeria’s revenues fell below expectations. Against a benchmark of 1.69 million barrels per day (mbpd), actual production hovered around 1.5 mbpd, largely due to oil theft, pipeline vandalism, and operational disruptions in the Niger Delta.

Even more striking was the exchange rate crisis. The 2023 budget was predicated on a naira-to-dollar rate of ₦435.57, yet the market reality soared to around ₦638/$ by year’s end. However, the country saw a silver lining in global oil prices. While the benchmark was pegged at $70 per barrel, the average market price outperformed expectations, closing the year at approximately $83.6 per barrel.

Despite that positive indicator, capital budget execution lagged. Procurement delays, weak revenue mobilisation, and a sluggish start under the new administration prompted the national assembly to take an extraordinary step, extending the 2023 Appropriation Act and it Supplementary Appropriation Act three times, from its original expiration to March 2024, then June, and finally to 31 December 2024.

This extended fiscal life created a financial overlap that soon snowballed into 2024.

READ ALSO: Tinubu signs N54.99 trillion 2025 budget into law

2024: Bigger promises, sharper contradictions

In December 2023, President Bola Tinubu proposed a record-breaking ₦27.5 trillion to the National Assembly on November 29, 2023. Following legislative deliberations, the National Assembly approved an increased budget of ₦28.7 trillion budget for 2024, continuing the trend of expansionary spending aimed at economic recovery and social protection.

Yet, by mid-year, the government faced widening gaps between its assumptions and economic realities. A supplementary budget of ₦6.2 trillion pushed the total spending closer to ₦35 trillion.

On paper, the assumptions looked more realistic than in 2023:

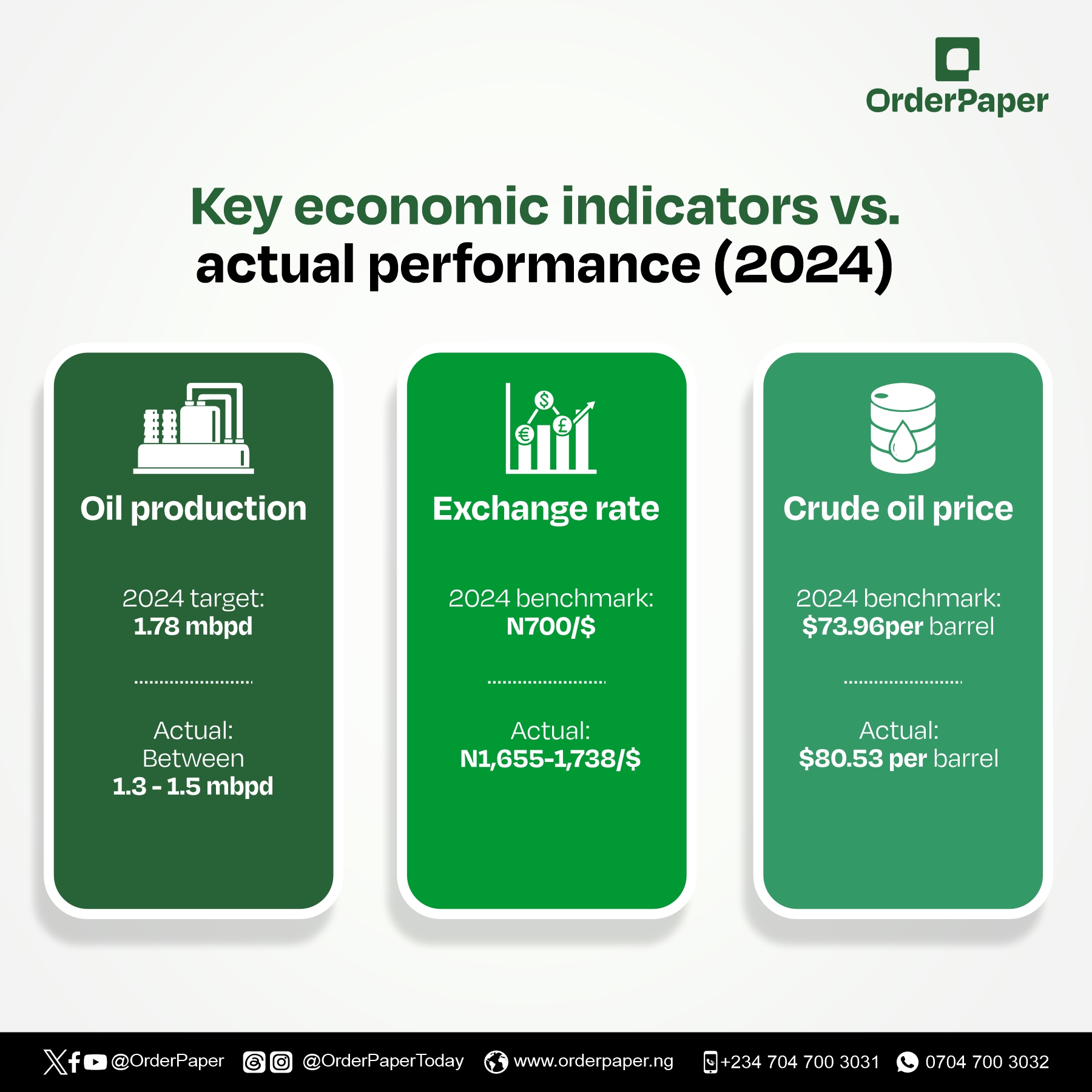

•Oil production target: 1.78 mbpd

•Exchange rate benchmark: ₦700/$

•Crude oil price benchmark: $73.96 per barrel

In practice, the government missed the mark on nearly every front. Oil production remained below target, fluctuating between 1.3 and 1.5 mbpd, while the naira continued its free fall, exchanging between ₦1,655 and ₦1,738/$. Only the oil price averaging $80.53 per barrel offered modest comfort.

To salvage project implementation and absorb procurement delays, the national assembly again intervened, extending the capital component of the 2024 budget until June 30, 2025.

This set the stage for a rare fiscal duality in 2025.

2025: A double-budget dilemma

By February 2025, the federal government signed a new budget into law – ₦54.99 trillion, the highest in Nigeria’s history. However, implementation were announced to begin in May, creating a brief vacuum during which only the extended 2024 capital budget was operational.

The 2025 budget is grounded on even more ambitious assumptions:

•Exchange rate: ₦1,400/$

•Crude oil price: $75 per barrel

But as of May, performance indicators suggest continued macroeconomic instability. The naira has fluctuated between ₦1,580 and ₦1,655/$, and oil prices dipped below the benchmark, trading between $60 and $70 per barrel.

This means Nigeria might likely be operating two active budgets:

1.The 2024 budget, specifically the capital component (extended to June 30, 2025), and

2.The 2025 budget, which was said to being implementation in May 2025.

National Assembly’s expanding burden

The multi-budget landscape is perceived to have significantly complicated the oversight role of the national assembly. Committees are now likely compelled to track and evaluate the implementation of multiple fiscal years simultaneously, each with distinct targets, priorities, and disbursement timelines.

This overlapping is most likely to increase the risk of duplication, ghost projects, and weakened accountability.

Experts perspective

In an interview with Parliament Reports, public policy analyst, Dr. Aliyu Ilias of CSA Advisory, delivered a candid critique of the national assembly’s performance in the current fiscal climate.

“In fact, the national assembly, for me, they are not getting their job right,” he said. “You know, passing a bill is not the major core job of the national assembly. You pass a bill when a bill is necessary. Not like this one where we are scoring people according to the number of bills they passed.”

According to Dr. Ilias, the core responsibility of the national assembly lies in carrying out rigorous oversight functions, especially on budget implementation. “Any budgetary allocation, they should follow it up and make sure that they actually implement what they want to implement. But with the budget calendar cycle problem now, it’s difficult to actually monitor it.”

He linked this oversight gap to the fiscal discontinuity introduced by the delayed implementation of budgets and the reliance on rollovers. The result, he warned, is overlapping projects and possible double appropriations. “By the time agencies are compiling another budget, they have not implemented the earlier one. So the same project can also find its way back. That’s a double one.”

Dr. Ilias also raised concerns about the fundamental assumptions of Nigeria’s budgets. “When you do a budget, what is the proposed income and proposed expenditure? But as it were, we are falling short,” he noted.

Budget cycles and oversight paralysis

Dr. Ilias further lamented the collapse of the January-to-December budget cycle, which had been restored under President Buhari but is now unraveling under the Tinubu administration. “It is quite sad that Buhari having made sure that he seriously followed the budget cycle from January to December, we have seen another trouble coming from President Bola Tinubu.

“I think it is unheard of that we cannot meet up the budget cycle. It doesn’t make our budget look streamlined or expected and the worst thing is that it is giving overlapping projects and double appropriation.”

To restore fiscal discipline, he urged that the national assembly must receive budget proposals by September at the latest. “I think we must as much as possible start early, at least at most by September. Let the budget be in the purview of the National Assembly and between September and October, November, it is also good we see our budget being implemented.”

To better understand how the finance committee is navigating this complexity, Parliament Reports spoke with Dr. Isah Imam Paiko, senior legislative aide to Sen. Sani Musa, chairman of the senate committee on finance.

Dr. Isah provided insight into the committee’s approach, emphasising that the current oversight focus is still on the extended 2024 capital expenditure component.

“As you are aware, the 2024 budget was extended to June 2025, but mostly this was in the area of capital expenditure, not recurrent expenditure because you will recall that the capital expenditure performed poorly in 2024, so it was extended to 2025.

“Recurrent expenditure started from January till the end of December. The capital was rolled over to allow for expenditure, so that the expenditure side can also perform very well.”

Dr. Isah clarified that capital expenditure for 2025 has not yet begun, and is expected to commence by July. Oversight activities in the meantime will focus largely on the 2024 capital budget’s implementation.

“When committees conduct oversight, they mostly invite MDAs to assess the progress of implementation,” he explained. “The performance of capital expenditure usually hovers around 60 to 70 percent. It is very difficult to achieve 80 percent performance unlike recurrent expenditure, which achieves nearly 99.9 percent.”

He noted that no oversight function had yet been carried out since the national assembly resumed from recess, and quarterly reports expected from MDAs had not been submitted.

“The MDAs are supposed to submit their report on a quarterly basis but as of now we have not received any report yet.

“However, as regards the finance committee, we are mostly concerned with the revenue aspect. Some agencies have submitted their quarterly report, but that is on the revenue side, not on the expenditure side.

“I can remember the upstream petroleum sector has submitted their report and the achievement and performance is very impressive even though it’s not 100 percent but i think it’s above 70 percent,” he added.

Dr. Isah added that these revenue figures are verified through documentation from the Office of the Accountant-General and the Fiscal Responsibility Commission.

He said, “When they are submitting their revenue for our profile, normally we verify from the Office of Accountant-General, they have to bring a document to prove the remittances they have so that we can assess the validity of the report. It’s not just to come and tell us what you have done. Yes, we verified that from the Fiscal Responsibility Commission, Office of Accountant-General, and even valid documents to show the transaction that have went on.”

The path forward

Nigeria’s current fiscal environment reflects both the ambition and the fragility of its economic strategy. While increased public spending aims to drive development, its success depends heavily on realistic assumptions, disciplined implementation, and robust oversight.

For the national assembly, the next challenge may not be just passing bigger budgets but ensuring that what is approved is actually delivered, within the timeframe, and with measurable impact.

If the trend of extensions, missed targets, and dual fiscal regimes persists, Nigeria may find itself caught in a cycle of budgeting without execution, a reality that no supplementary appropriation can fix.

Motions & Movement is an initiative of OrderPaper that tracks motions raised by lawmakers during plenary and offers insights into the progress of resolutions by parliamentary committees.