Speaker Abbas has assured that the tax reform bills will be thoroughly examined to ensure they serve the best interests of Nigerians

The Speaker of the House of Representatives, Tajudeen Abbas, has assured Nigerians that the House will meticulously examine the proposed tax reform bills to ensure they serve the best interests of the people.

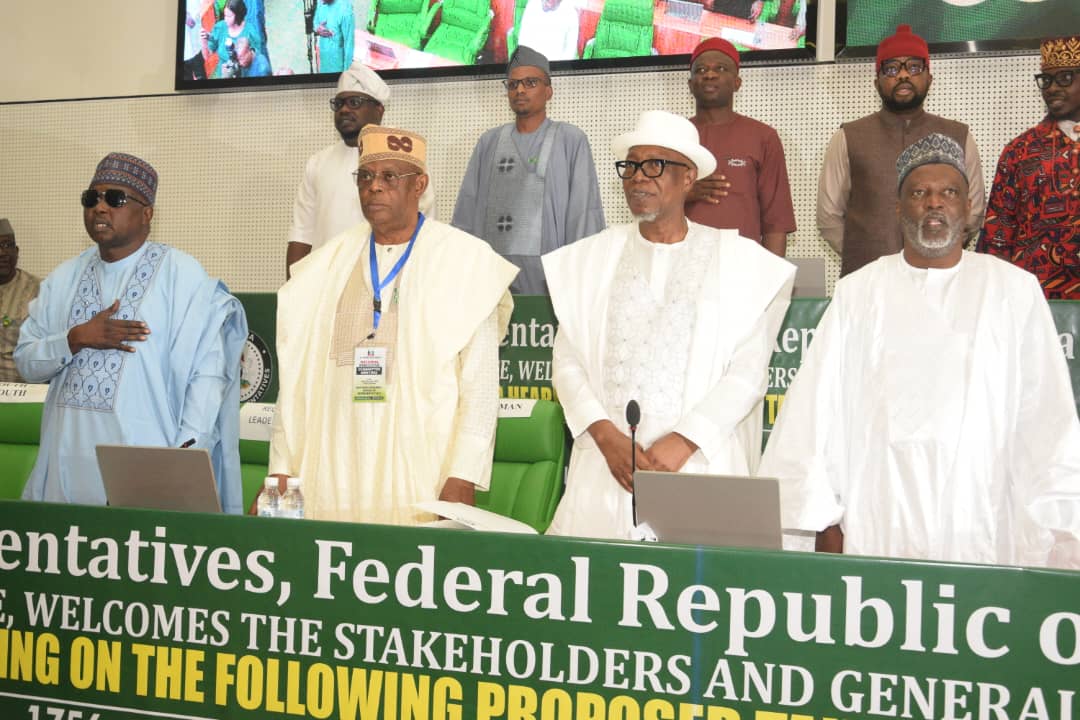

Speaking at a public hearing on the bills in Abuja on Wednesday, organised by the Special Committee on Tax Reform Bills, Rep. Abbas who was represented by the Leader of the House Rep. Julius Ihonvbere (APC Edo) acknowledged the significance of the reforms and the public concern they have generated.

The tax bills were first transmitted to the House by president Bola Tinubu on October 23, 2024 and passed second reading on February 12, 2205. The bills under consideration include:

- The Nigeria Tax Bill which seems to repeal existing tax laws and consolidate them into a unified, simplified legal framework for taxation.Nigeria Tax Administration Bill

- The Nigeria Tax Administration Bill which establishes a structured process for tax administration, covering assessment, collection, and revenue accounting across all levels of government.

- The Nigeria Revenue Service (Establishment) Bill: proposes replacing the Federal Inland Revenue Service (FIRS) with the Nigeria Revenue Service (NRS) to improve tax collection efficiency.

- The Nigeria Joint Revenue Service Bill: Creates the Joint Revenue Board, Tax Appeal Tribunal, and Office of Tax Ombud to harmonize tax administration and resolve disputes.

According to the Speaker, the House recognises the critical role of these bills in economic reforms, as well as the public debates and discussions they have sparked.

“The tax reform bills have generated widespread debate in the media, public domain, and private discussions, reflecting their importance,” he said.

The Speaker reaffirmed that the reforms are designed to diversify Nigeria’s revenue base, promote equity, and foster an enabling environment for investment and innovation.

He noted that President Tinubu’s administration introduced the tax reforms to improve Nigeria’s tax-to-Gross Domestic Product (GDP) ratio by broadening and streamlining the tax system.

“However, as representatives of the people, I have continued to hold the view that we must approach these reforms thoughtfully, understanding their potential implications for every segment of society.

“Taxes should be fair, transparent and justifiable, balancing the need for public revenue with the burdens they impose on individuals and businesses.

“The House will, therefore, scrutinise these bills thoroughly, ensuring they align with the best interests of our constituents and the nation at large.

“We owe this duty to Nigerians, and as the people’s representatives, we must always be accountable to them,” he said.

Abbas highlighted Nigeria’s low tax-to-GDP ratio, noting that despite being Africa’s largest economy, the country still struggles with a 6 percent tax-to-GDP ratio.

“This is far below the global average and the World Bank’s minimum benchmark of 15 per cent for sustainable development.

“This is a challenge we must address if we are to reduce our reliance on debt financing, ensure fiscal stability and secure our future as a nation.

“Together, let us seize this opportunity to bring forth a tax system that serves the best interests of all Nigerians,” he said.

The speaker explained that the public hearing would enable lawmakers to identify areas of the bills that require amendment, clarification, or improvement while ensuring they align with the Nigerian Constitution and existing laws.

He urged stakeholders in the tax system to actively participate in discussions and provide insightful recommendations.

“In every modern state, taxes are the bedrock of public revenue, providing the resources required to deliver education, healthcare, infrastructure, and security,” he added.

Nigeria’s Urgent Need for Tax Reforms

Earlier, chairman of the special committee on tax reform bills, James Faleke (APC Lagos), underscored the urgency of tax reforms, citing Nigeria’s relatively low tax collection rate compared to other African nations.

ALSO READ: Tax Reforms: Senate adjourns for retreat and more consultations

He referenced 2023 IMF data, which showed that Nigeria’s tax-to-GDP ratio stood at approximately 9.4%, compared to South Africa’s 21.6%, Kenya’s 14.1%, and Senegal’s 19.1%.

Faleke also disclosed that in 2023, the total taxes and levies collected by the federal, state, and local governments amounted to ₦26.03 trillion. However, the Joint Tax Board (JTB) reported that only 35 million Nigerians pay tax, with merely 9% of registered companies captured in the tax net.

“This imbalance is unsustainable if we are to adequately fund critical infrastructure needed to build the Nigerian economy to a desirable level.

“Experts have estimated that Nigeria requires $3 trillion (₦1.8 quadrillion) over the next 30 years, which is equivalent to $100 billion annually, to bridge its infrastructure deficit.

“However, our internally generated revenue (IGR) falls significantly short of this amount, leading the government to borrow substantially in order to bridge the funding gap.

“This reality highlights the urgency of implementing tax reforms that will simplify and enhance revenue collection, reduce reliance on borrowing, and drive sustainable development,” Rep. Faleke said.