Parliamentarian, environmentalist and renewable energy enthusiast, Rep.Ugbor says the tax reform bills do not explicitly spell out incentives for renewable energy investments

Rep. Terseer Ugbor, deputy chairman of the House of Representatives committee on environment, has underscored the need for Nigeria’s ongoing tax reforms to actively support sustainable development and the nation’s clean energy ambitions.

Speaking at the second edition of the Rembinar Dialogue Series on Monday, themed “Tax Bills and Implication for Energy Transition,” Rep. Ugbor—who represents Kwande-Ushongo federal constituency of Benue state—emphasised the crucial links between tax policy, environmental protection, and economic growth.

“The whole concept of the tax reforms is to change the way tax administration is done in Nigeria, in a way that positively impacts revenue mobilisation, livelihoods, job creation, and economic development,” he said. “The reforms seek a unified tax administration system across the federation—federal, states, and local governments—but there must be a transition period where all tiers of government move collectively and gradually.”

While lauding the House of Representatives’ recent passage of four major tax reform bills, Rep.Ugbor pointed out that they fall short in areas vital to the energy transition, particularly incentives for renewable energy investment.

“The current reform bills do not explicitly spell out incentives for renewable energy investments,” Rep. Ugbor noted, adding: “But through regulatory frameworks from agencies like the National Environmental Standards and Regulations Enforcement Agency (NESREA) and the National Automotive Council, we are moving towards incentivizing cleaner environmental practices within industrial processes.”

He cited efforts by the (NESREA) as an example, saying, “NESREA has designed policies that create some kind of environmental tax and levies on industries and companies that produce goods and services in the country. The whole idea is to disincentivize environmental pollution and CO2 emissions from these companies.”

Push for Green Tax to Support Clean Energy

Ugbor, a strong advocate for environmental sustainability, also emphasized the importance of introducing a “green tax” to drive Nigeria’s energy transition efforts.

“A green tax remains one of the most effective tools to promote renewable energy adoption,” he said. “It should cover energy, transport, pollution, and natural resource taxes, incentivizing cleaner production and discouraging environmental degradation.”

ALSO READ: ‘Youth innovation key to energy transition’

He recalled that a green tax initiative was introduced under the previous administration but was later repealed during the current tax reform process. “We must reintroduce the green tax to ensure that companies who pollute the most contribute towards renewable energy infrastructure and climate resilience,” Rep. Ugbor urged

Balancing Transition with Economic Realities

Ugbor, however, cautioned against a hasty transition that might harm Nigeria’s economy or workers, given the nation’s dependence on fossil fuel revenues.

“Nigeria still generates most of its income from oil and gas. In transitioning, we must ensure we do not put our workers in the fossil fuel industry out of jobs. Capacity building, retraining, and gradual integration are essential,” he said.

Referencing insights from international climate forums like COP, he added that a just energy transition must prioritize worker welfare and cross-sector collaboration.

States Must Adapt to Reforms

On how sub-national governments can align with the federal tax agenda, Rep. Ugbor urged proactive reforms by state and local authorities.

“It’s one of the issues we pondered upon very deeply, especially for me from Benue State. As you know, part of what this tax reform seeks to drive home is VAT—and certain goods and services, like food, have been exempted.”

He pointed out the unique challenge for agrarian states like Benue, where unprocessed food sold directly from farms to markets, may generate little to no VAT.

“How do we benefit from the VAT reforms? Our food production and sales are not value-added. So states need to think deeply about how to benefit from the new tax structure and design local tax policies through their own laws in alignment with federal objectives.”

Ugbor identified local-level opportunities such as waste management and environmental taxation as areas for innovation.

Streamlining the Tax Burden

Concluding, Rep. Ugbor reiterated that the goal of the reform is not to burden citizens, but to simplify the tax regime and promote fairness.

“It seeks to reduce the incidence of double taxation and over-taxation. It also seeks to ease the tax burden on the poorest of the poor.”

He clarified that the tax reforms include income thresholds below which individuals and companies are exempt.

“If you’re not earning more than 50 million as a company, you don’t pay tax. And if you’re earning below 2 or 3 million as an individual per annum, you’re exempt. So the tax regime really considers the burden on lower-income people and provides some relief,” he assured.

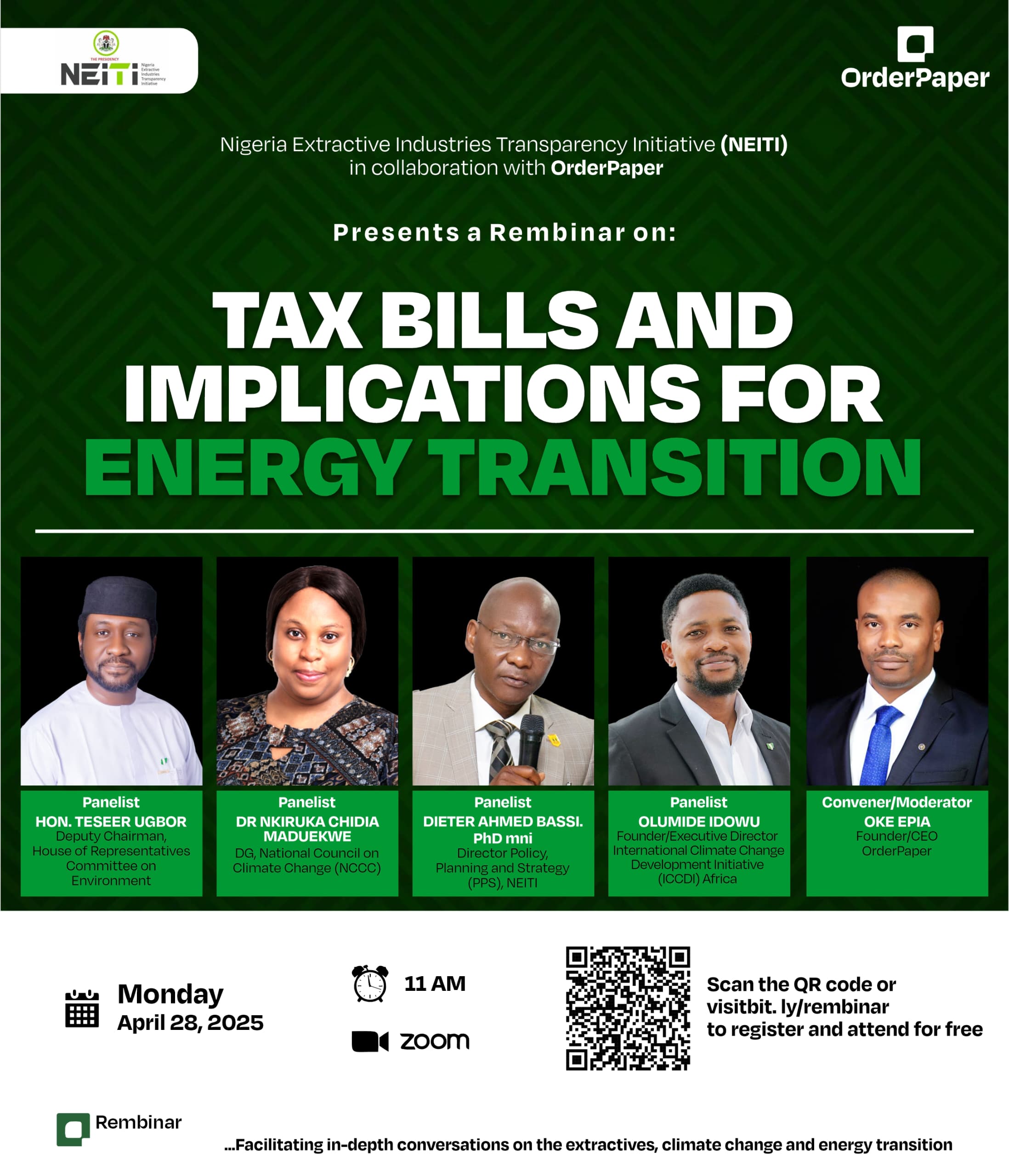

About the Rembinar Dialogue Series

The Rembinar Series, a joint initiative by OrderPaper Nigeria and the Nigeria Extractive Industries Transparency Initiative (NEITI), is designed to foster dialogue on resource governance, fiscal transparency, and accountability in Nigeria’s extractive sector.

The inaugural edition in March 2025, titled “Tax Bills and Implications for NEITI Audits,” gathered over 100 stakeholders and featured contributions from NEITI’s Executive Secretary Dr. Orji Ogbonnaya Orji, fiscal policy expert Mallam Haruna Yahaya, and natural resource governance expert Dr. Mike Uzoigwe.

This second edition shifted focus to the nexus between tax policy and Nigeria’s energy transition. The session featured a high-level panel including:

- Rep. Terseer Ugbor, Deputy Chairman, House Committee on Environment

- Dr. Dieter Ahmed Bassi, Director, Policy, Planning and Strategy (PPS), NEITI

- Olumide Idowu, Founder and Executive Director, ICCDI Africa

- Dr. Nkiruka Chidia Maduekwe, DG, National Council on Climate Change (represented by Awele Ikobi-Anyali)

The session was moderated by Mr. Oke Epia, CEO of OrderPaper Nigeria.