Amid growing climate challenges and a global push for sustainability, Nigeria has laid out an ambitious energy transition roadmap. But as the country envisions a cleaner, greener future, how aligned are its tax reforms with this ambition? Here’s a closer look at the recently introduced tax reforms and their implications

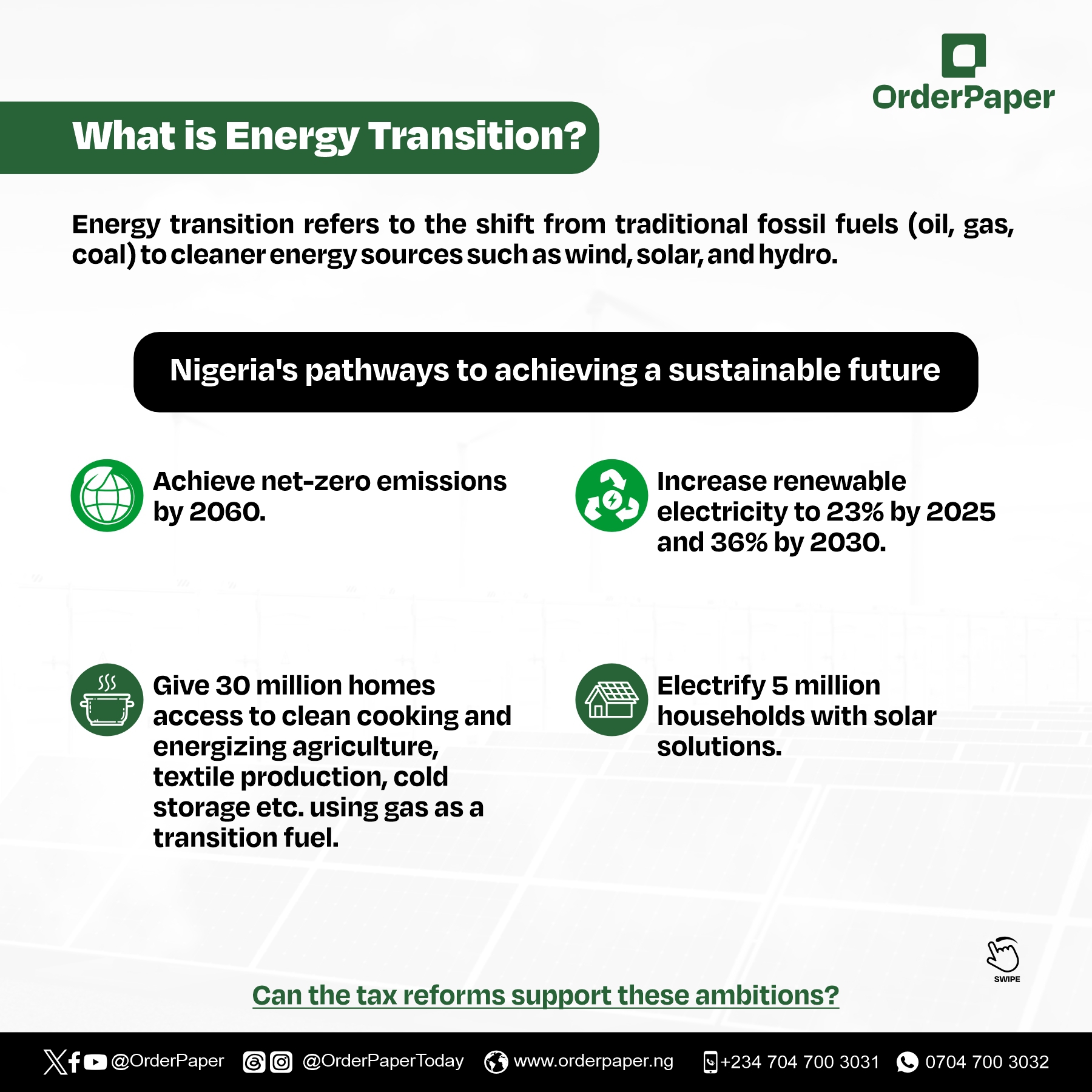

What is Energy Transition?

Energy transition refers to the shift from traditional fossil fuels like oil, gas, and coal to cleaner, more sustainable sources such as wind, solar, and hydro power. For Nigeria, the journey to a low-carbon economy is both urgent and strategic.

To achieve its dream of a sustainable future, Nigeria aims to:

- Achieve net-zero emissions by 2060.

- Increase renewable electricity to 23 percent by 2025 and 36 percent by 2030.

- Provide 30 million homes with access to clean cooking energy.

- Electrify 5 million households with solar solutions.

Why Does This Shift Matter?

For Nigeria, energy transition is not just about saving the environment but also about improving the quality of daily living.

For millions living without reliable electricity, especially in rural areas, the transition promises better access to affordable, stable power through solar mini-grids and cleaner cooking options.

This reduces health risks from air pollution and dependence on expensive fuel generators and dangerous cooking methods like firewood and charcoal.

It also means more jobs in emerging industries like solar installation, equipment maintenance, and green entrepreneurship, creating fresh income streams and empowering youth in underserved communities.

On a broader scale, energy transition can diversify Nigeria’s economy, which is currently over-dependent on oil revenues.

As the world gradually moves away from fossil fuels, Nigeria risks being left behind unless it begins to invest meaningfully in renewable energy infrastructure.

A well-managed transition allows the country to position itself as a leader in the green economy, attracting international climate finance, technology transfer, and partnerships while reducing vulnerability to global oil price shocks.

It’s a strategic move to ensure economic stability, energy independence, and sustainable growth, making the economy more resilient and future-ready.

But as promising as these goals sound, the big question remains: Can Nigeria’s tax system support this bold transition?

READ ALSO: Orderpaper hosts second Rembinar Dialogue on Energy Transition

A Quick Overview of the Tax Bills

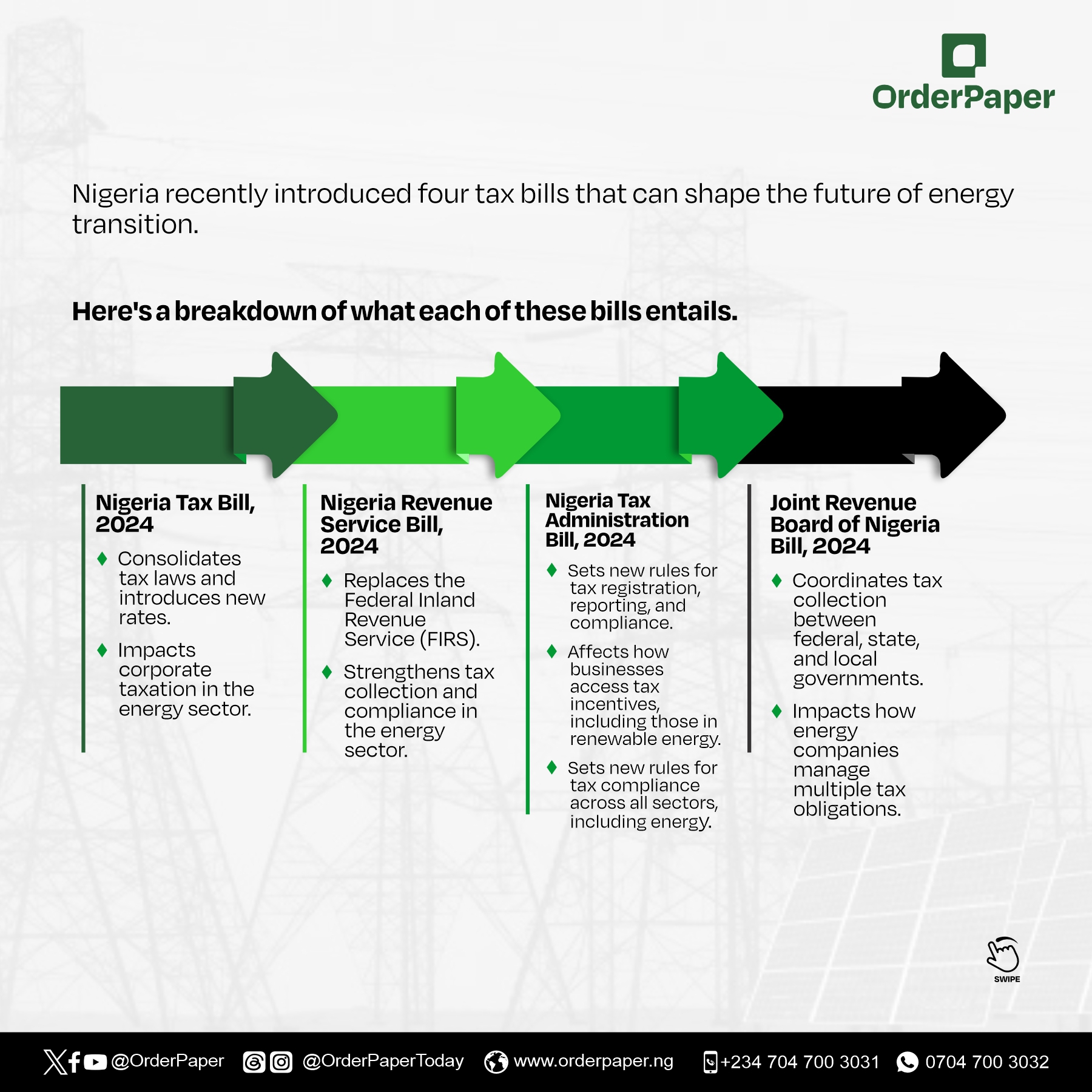

In 2024, four major tax-related bills were introduced, aiming to streamline revenue generation, improve tax compliance and attract investment.

Here’s a breakdown of what each of these bills entails.

1. Nigeria Tax Bill, 2024

- Consolidates existing tax laws.

- Introduces revised tax rates affecting corporate taxation in the energy sector.

2. Nigeria Revenue Service Bill, 2024

- Replaces the Federal Inland Revenue Service (FIRS).

- Strengthens tax collection and compliance in the energy sector.

3. Nigeria Tax Administration Bill, 2024

- Sets new rules for tax registration, reporting, and compliance.

- Affects how businesses access tax incentives, including those in renewable energy.

4. Joint Revenue Board of Nigeria Bill, 2024

- Coordinates tax administration between federal, state, and local governments.

- Impacts how energy companies manage multiple tax obligations.

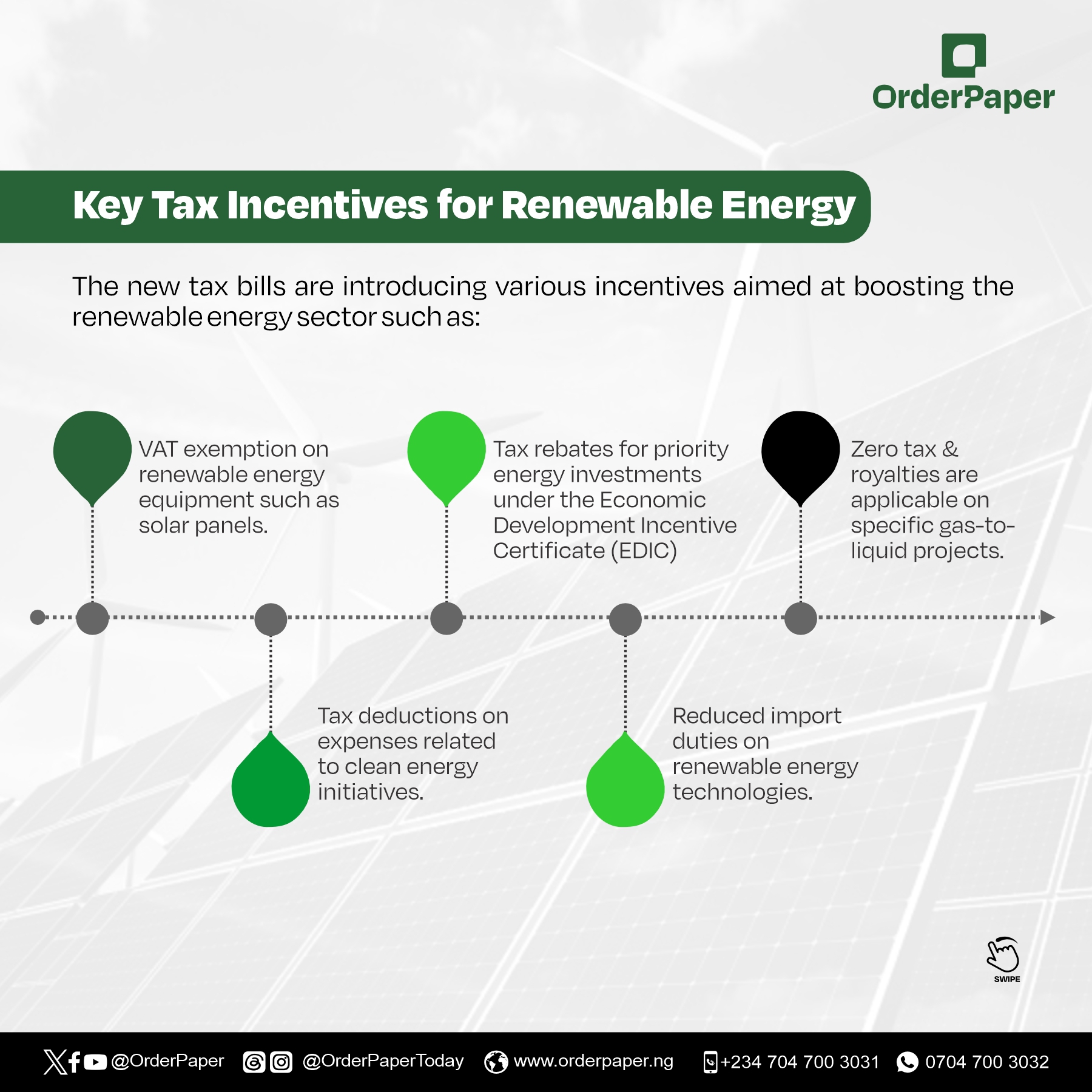

Provisions for Renewable Energy

The new tax framework introduces incentives aimed at making renewable energy adoption more attractive. These include:

- VAT exemption on renewable energy equipment such as solar panels.

- Tax rebates for priority energy investments under the Economic Development Incentive Certificate (EDIC)

- Zero tax & royalties are applicable on specific gas-to-liquid projects.

- Tax deductions on expenses related to clean energy initiatives.

- Reduced import duties on renewable energy technologies.

READ ALSO: NEITI launches research on energy transition

Gaps in the Reforms

While these reforms are promising, there are several gaps in the current reform agenda:

- No clear carbon tax.

- Emissions taxation was introduced but lacks structure.

- No clear long-term framework for sustaining tax incentives.

- Greater emphasis on gas for commercialization rather than as a bridge to renewables.

- Insufficient provisions for addressing energy poverty in rural areas.

- Lack of innovative financing mechanisms like carbon markets.

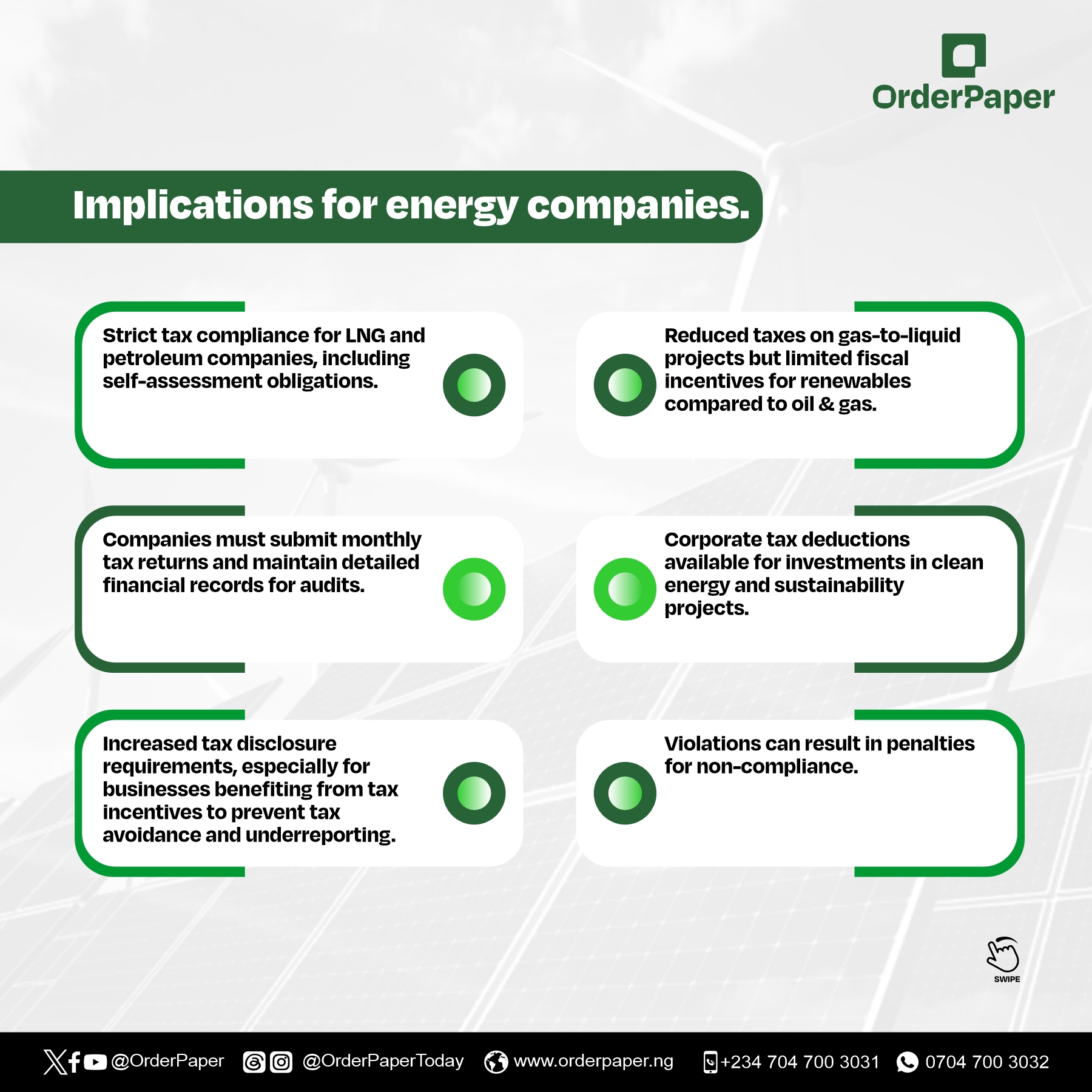

Implications for Energy Companies

- Strict tax compliance for LNG and petroleum companies, including self-assessment obligations.

- Companies must submit monthly tax returns and maintain detailed financial records for audits.

- Increased tax disclosure requirements, especially for businesses benefiting from tax incentives to prevent tax avoidance and underreporting.

- Reduced taxes on gas-to-liquid projects but limited fiscal incentives for renewables compared to oil & gas.

- Corporate tax deductions available for investments in clean energy and sustainability projects.

- Violations can result in penalties for non-compliance.

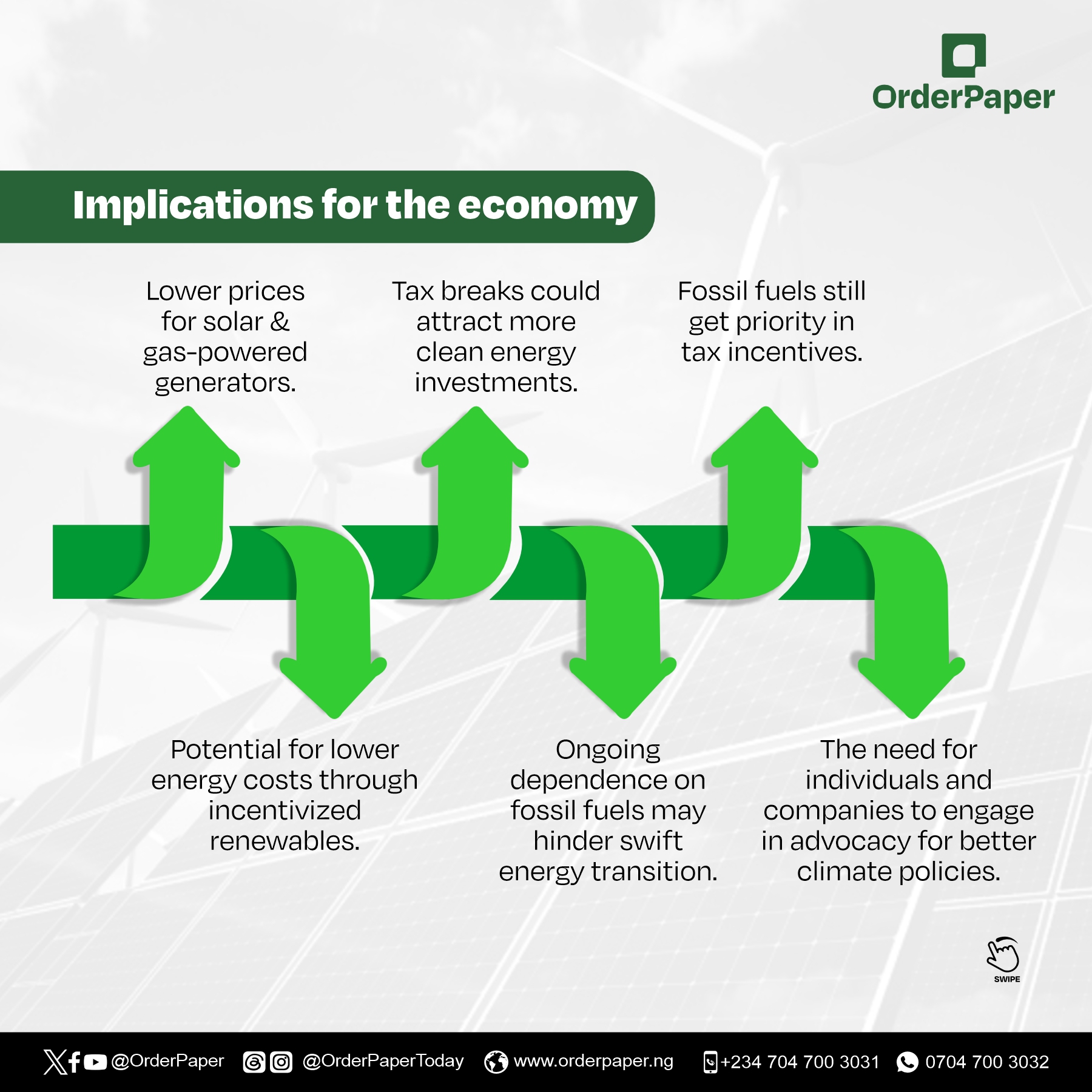

Implications for the economy

- Lower costs for clean energy equipment like solar panels and gas generators.

- More investment in renewable energy due to tax breaks.

- Potential for lower energy costs through incentivized renewables.

- Ongoing dependence on fossil fuels may hinder swift energy transition.

- The need for individuals and companies to engage in advocacy for better climate policies.

- Greater job opportunities in the renewable energy space.

Nigeria’s tax reforms suggest a growing recognition of the critical role clean energy plays in national development.

However, bridging policy ambition with practical implementation will require more targeted reforms, stakeholder engagement, and consistent fiscal support.

If Nigeria truly wants to lead the green future, then its tax strategy must tally with its energy transition goals balancing short-term realities with long-term sustainability.