At Rembinar 2.0, the NCCC emphasises the role of carbon markets and climate accountability in Nigeria’s tax reform agenda.

The Head of Legal Services at the National Council on Climate Change (NCCC), Awele Ikobi-Anyali, has underscored the urgent need for Nigeria’s fiscal laws and tax reforms to align with climate policy, particularly through the inclusion of a carbon tax mechanism.

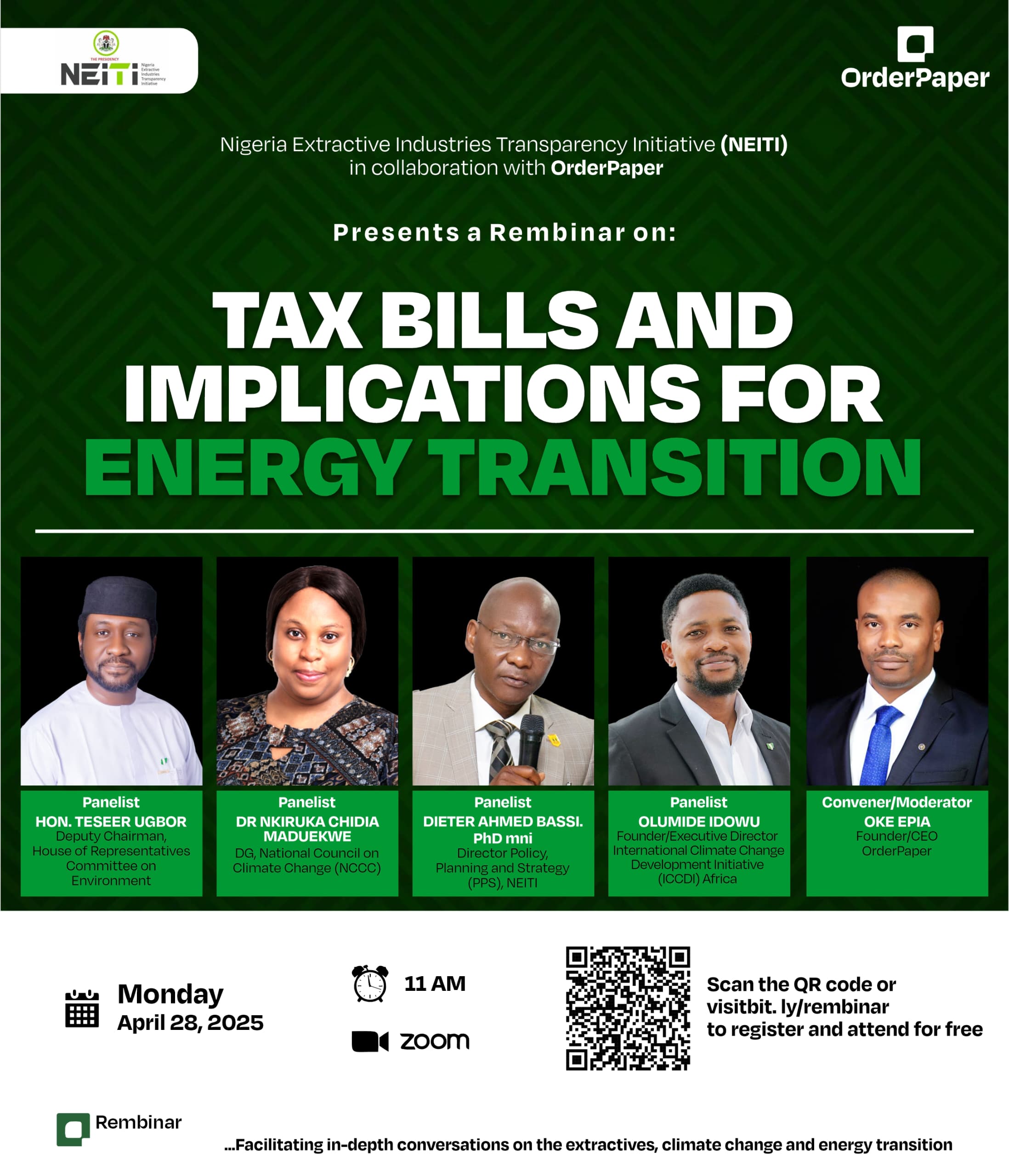

She made the call while representing the NCCC’s Director-General, Dr. Nkiruka Maduekwe, at the second edition of the Rembinar Dialogue Series held on Monday, 28 April 2025. Themed “Tax Bills and Implications for Energy Transition”, the dialogue interrogated how fiscal policies and tax reforms could either accelerate or undermine Nigeria’s clean energy ambitions.

Ikobi-Anyali emphasised that Nigeria’s fiscal policy must align more deliberately with the provisions of the Climate Change Act, especially as the country pursues a just and inclusive energy transition.

Referencing Nigeria’s Climate Change Act, she said the country already has the legislative mandate to build a carbon taxation system that can drive emissions reduction while funding renewable energy projects.

“Section 4 (I) of our Act states that we can collaborate with the Federal Inland Revenue Service to develop a mechanism for carbon tax in Nigeria and I think one of the key aspects is us developing the carbon tax,” she said.

She explained that this tool would not only serve as an incentive to reduce greenhouse gas emissions but also provide a steady revenue stream to fund clean energy development.

In her view, Nigeria’s current tax reform efforts, including the proposed tax bills, are yet to sufficiently prioritise renewable energy and climate finance. While there are provisions for VAT exemptions on electric vehicles and solar products, she noted that these incentives are not comprehensive enough. The real need, she said, is to integrate a clear carbon tax structure into relevant fiscal laws.

She disclosed that NCCC is already working on a regulatory framework for the carbon market, which would provide legal backing for carbon credit projects and ensure that revenues from such schemes are reinvested into renewable energy infrastructure.

Ikobi-Anyali also pointed to other critical sections of the Climate Change Act, such as Section 22, which mandates MDAs to include climate change considerations in their annual budgets, and Section 19, which sets a carbon budget aimed at limiting global temperature increases.

She said, “Section 22 (3) says that the ministry responsible for finance, budgets and national planning shall ensure that all budget proposals submitted by MDAs have been properly vetted and considered for climate change considerations and that adequate allocation is provided for them on the appropriate surface in the annual project.

“Section 19 (8) says carbon budgets for Nigeria should keep average increases in global temperature within two degrees centigrade and pursue efforts to eliminate the temperature increase,” Ikobi-Anyali added.

She stressed that fiscal policy should not exist in isolation from Nigeria’s climate obligations. Instead, both should work hand-in-hand to drive the country’s net-zero goals by 2060. Without integrating climate-conscious tools like carbon taxes and carbon market regulations, she warned, Nigeria risks falling short of its climate commitments.

The tax bills and energy transition

The ongoing fiscal reform process includes four tax-related bills currently passed by the House of Representatives and awaiting passage from the Senate: Nigeria Tax Bill (NTB) 2024, Nigeria Tax Administration Bill (NTAB), Nigeria Revenue Service (Establishment) Bill (NRSEB), and Joint Revenue Board (Establishment) Bill (IRBEB)

These bills aim to harmonise tax collection, eliminate double taxation, and introduce efficiency in public finance. However, climate experts like Ikobi-Anyali warn that without clear provisions for renewable energy, carbon tax, and emissions regulation, the reforms may fall short of supporting Nigeria’s transition goals.

About the Rembinar series

The Rembinar is a digital dialogue series organised by RemTrack, the civic-tech arm of OrderPaper, in partnership with the Nigeria Extractive Industries Transparency Initiative (NEITI). The platform convenes stakeholders from government, civil society, and the private sector to explore issues at the intersection of extractive governance, fiscal reform, and climate policy.

The first edition, held in March 2025, focused on the implications of tax policy for NEITI’s audit work. The second edition examined how fiscal policy can enable or impede Nigeria’s journey to net-zero emissions. Panelists included Rep. Terseer Ugbor, NEITI’s Dr. Dieter Bassi, climate advocate Olumide Idowu, and Awele Ikobi-Anyali who represented the NCCC’s Director-General, Dr. Nkiruka Maduekwe.